What You Need to Buy a Car: A Comprehensive Guide

Buying a car is a significant financial decision that involves careful planning, research, and consideration. Whether you are a first-time buyer or looking to upgrade your vehicle, understanding the essential steps and requirements can help make the process smoother and more efficient. This article will provide a detailed overview of what you need to buy a car, including financial considerations, documentation, and tips for making an informed decision.

Introduction

Purchasing a car is often one of the largest investments individuals make after buying a home. The process can be overwhelming, with numerous options available and various factors to consider. From choosing the right vehicle to securing financing, understanding what you need before making a purchase is crucial for a successful transaction.

Importance of Preparation

Preparation is key when buying a car. By gathering the necessary information and resources beforehand, you can avoid common pitfalls and ensure that you make a well-informed decision. This guide will walk you through the essential steps to take before buying a car.

Steps to Take Before Buying a Car

1. Determine Your Budget

Before you start shopping for a car, it’s essential to establish a budget. This budget should include not only the purchase price of the vehicle but also additional costs such as taxes, registration, insurance, and maintenance.

Key Considerations:

- Total Cost of Ownership: Consider the total cost of ownership, which includes fuel, maintenance, insurance, and depreciation.

- Monthly Payments: If financing, determine how much you can afford to pay each month without straining your finances.

- Down Payment: Aim for a down payment of at least 20% to reduce your monthly payments and interest costs.

2. Research Vehicle Options

Once you have a budget in mind, begin researching the types of vehicles that fit your needs and budget. Consider factors such as:

- Body Style: Sedan, SUV, truck, or hatchback.

- Fuel Efficiency: Gasoline, diesel, hybrid, or electric options.

- Safety Ratings: Look for vehicles with high safety ratings from organizations like the National Highway Traffic Safety Administration (NHTSA) or the Insurance Institute for Highway Safety (IIHS).

- Reliability: Research the reliability of different makes and models through consumer reports and reviews.

3. Check Your Credit Score

Your credit score will play a significant role in determining your financing options and interest rates. Before applying for a loan, check your credit score and take steps to improve it if necessary.

Tips for Improving Your Credit Score:

- Pay down existing debts.

- Make all payments on time.

- Avoid opening new credit accounts before applying for a car loan.

4. Explore Financing Options

There are several financing options available for purchasing a car:

- Bank Loans: Traditional banks often offer competitive rates for auto loans.

- Credit Unions: Credit unions may provide lower interest rates and better terms than traditional banks.

- Dealership Financing: Many dealerships offer financing options, but be cautious of higher interest rates.

- Leasing: If you prefer driving a new car every few years, consider leasing instead of buying.

5. Gather Necessary Documentation

When you are ready to buy a car, you will need to provide specific documentation. This may include:

| Document | Description |

|---|---|

| Driver’s License | A valid driver’s license to prove your identity and eligibility to drive. |

| Proof of Income | Recent pay stubs or tax returns to verify your income for financing purposes. |

| Credit Report | A copy of your credit report, if available, to provide to lenders. |

| Insurance Information | Proof of insurance coverage, which is typically required before driving off. |

| Trade-In Documents | If you are trading in a vehicle, have the title, registration, and maintenance records ready. |

6. Test Drive the Vehicle

Before making a purchase, it’s crucial to test drive the vehicle to ensure it meets your expectations. Pay attention to:

- Comfort: Evaluate the seating and driving position.

- Visibility: Check for blind spots and overall visibility.

- Handling: Assess how the car handles in different driving conditions, including acceleration and braking.

7. Negotiate the Price

Once you’ve selected a vehicle, it’s time to negotiate the price. Here are some tips for effective negotiation:

- Research Market Value: Know the fair market value of the vehicle based on its make, model, year, and condition.

- Be Prepared to Walk Away: If the dealer is unwilling to meet your price, be prepared to walk away and explore other options.

- Consider Additional Costs: Factor in taxes, fees, and other costs when negotiating the final price.

8. Finalize the Purchase

After reaching an agreement on the price, you’ll need to finalize the purchase. Review the sales contract carefully, ensuring that all terms are clear and accurate.

Key Components of the Sales Contract:

- Purchase Price: Confirm the agreed-upon price.

- Financing Terms: Review the interest rate, loan term, and monthly payment details.

- Warranty Information: Understand the warranty coverage and any additional options available.

9. Complete the Paperwork

Once you’ve signed the contract, complete the necessary paperwork for registration and title transfer. Ensure that you receive copies of all documents for your records.

10. Take Delivery of Your Vehicle

After completing the paperwork, it’s time to take delivery of your new car. Before driving off, do a final inspection to ensure everything is in order.

Additional Considerations

1. New vs. Used Cars

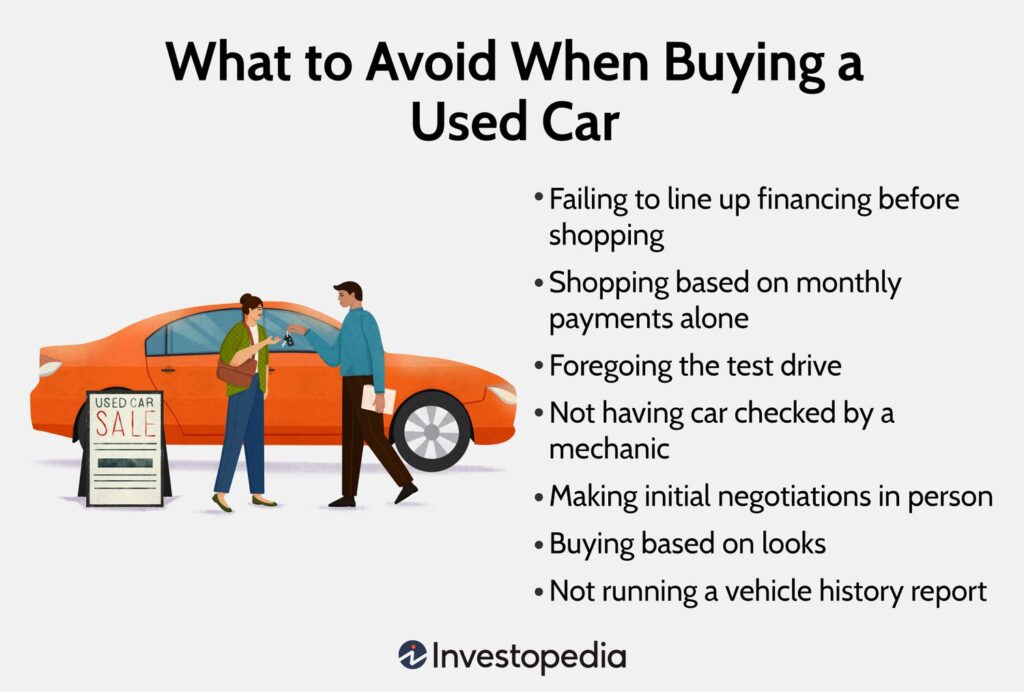

Deciding between a new and used car is a significant consideration. New cars come with warranties and the latest features, but they depreciate quickly. Used cars can offer better value, but it’s essential to check their condition and history.

2. Insurance Costs

Insurance costs can vary significantly based on the make and model of the car, your driving history, and your location. Get quotes from multiple insurance providers to find the best coverage at the most competitive rates.

3. Maintenance and Repairs

Consider the long-term maintenance costs associated with the vehicle you choose. Some brands and models are known for their reliability and lower maintenance costs, while others may require more frequent repairs.

4. Environmental Impact

If you are concerned about the environment, consider fuel-efficient or electric vehicles. These options can reduce your carbon footprint and save you money on fuel in the long run.

Conclusion

Buying a car is a significant investment that requires careful planning and consideration. By following the steps outlined in this guide, you can make an informed decision that meets your needs and budget. Whether you choose a new or used vehicle, understanding the process will help ensure a smooth car-buying experience.

Frequently Asked Questions (FAQs)

1. What do I need to buy a car?

To buy a car, you typically need a valid driver’s license, proof of income, a credit report, insurance information, and any necessary documents for a trade-in.

2. How do I determine my budget for a car?

Consider your total cost of ownership, including monthly payments, insurance, maintenance, and fuel costs. Aim for a budget that does not exceed 20% of your take-home pay.

3. Should I buy a new or used car?

The choice between a new or used car depends on your budget, preferences, and needs. New cars come with warranties and the latest features, while used cars can offer better value.

4. How can I negotiate the price of a car?

Research the market value of the vehicle, be prepared to walk away if necessary, and consider additional costs when negotiating.

5. What is the importance of a test drive?

A test drive allows you to assess the comfort, visibility, and handling of the vehicle before making a purchase.

6. How do I check the history of a used car?

You can obtain a vehicle history report using the car’s VIN (Vehicle Identification Number) through services like Carfax or AutoCheck.

7. What financing options are available for buying a car?

You can explore financing through banks, credit unions, dealerships, or independent finance companies.

8. How do I ensure I get a good insurance rate?

Get quotes from multiple insurance providers and consider factors such as your driving history, the vehicle’s make and model, and available discounts.

9. What should I do if I have bad credit?

Look for lenders that specialize in bad credit auto loans or consider working with a co-signer to improve your chances of approval.

10. Where can I find more information on buying a car?

For more detailed information on car buying, you can visit the Consumer Financial Protection Bureau (CFPB) website.

Table: Key Steps in the Car Buying Process

| Step | Description |

|---|---|

| Determine Your Budget | Establish a budget that includes purchase price, taxes, insurance, and maintenance costs. |

| Research Vehicle Options | Explore different makes and models based on your needs and preferences. |

| Check Your Credit Score | Review your credit score and take steps to improve it if necessary. |

| Explore Financing Options | Investigate various financing options, including banks, credit unions, and dealership financing. |

| Gather Necessary Documents | Prepare required documentation, including a driver’s license, proof of income, and insurance info. |

| Test Drive the Vehicle | Take the car for a test drive to assess comfort and handling. |

| Negotiate the Price | Engage in negotiations to reach an agreeable price for the vehicle. |

| Finalize the Purchase | Review and sign the sales contract, ensuring all terms are clear. |

| Complete the Paperwork | Finalize registration and title transfer paperwork. |

| Take Delivery of Your Vehicle | Inspect the car one last time before driving it off the lot. |

This comprehensive guide provides insights into what you need to buy a car and the steps involved in the process.