How to Void a Check

Voiding a check is a simple process that involves marking a check as invalid or unusable. This is typically done when a check is lost, stolen, or contains incorrect information. By voiding a check, you prevent unauthorized individuals from accessing your bank account and misusing the check. In this comprehensive guide, we’ll walk you through the steps to void a check and provide answers to frequently asked questions.

Understanding the Importance of Voiding Checks

Voiding a check is crucial for maintaining the security of your financial information and preventing potential fraud. When a check is lost or stolen, it can be used by unauthorized individuals to withdraw money from your account or make unauthorized purchases. By voiding the check, you can prevent these fraudulent activities and protect your financial well-being.

Steps to Void a Check

- Locate the check: Find the check you want to void. It’s important to have the check in hand to ensure you’re voiding the correct one.

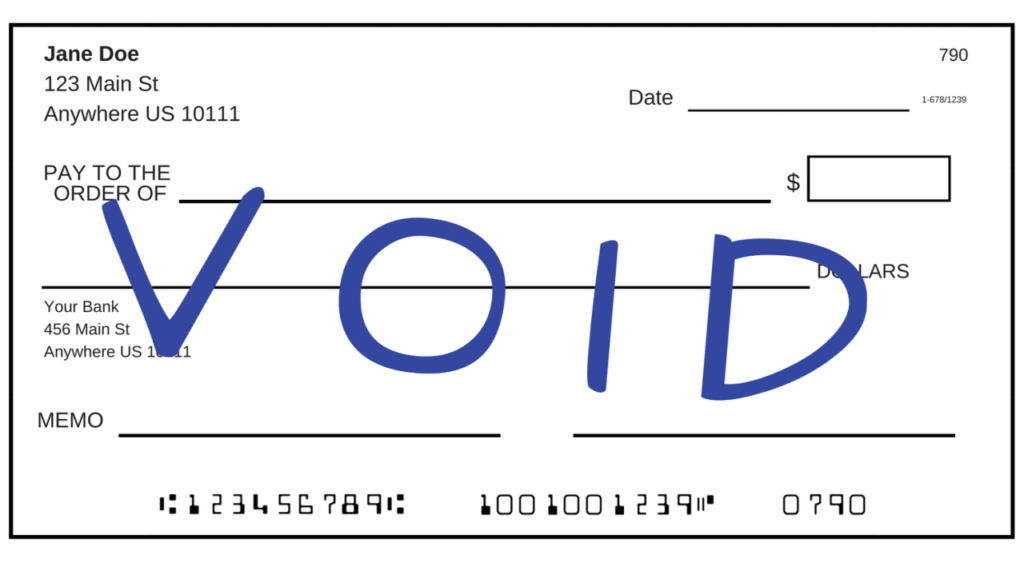

- Write “VOID” across the check: Using a pen or marker, write the word “VOID” across the front of the check in large letters. This makes the check invalid and unusable.

- Destroy the signature line: Draw a line through the signature line to prevent anyone from signing the check and attempting to use it.

- Destroy the MICR line: The MICR (Magnetic Ink Character Recognition) line at the bottom of the check contains important banking information, such as your account number and routing number. Draw a line through this line to prevent unauthorized access to your account details.

- Notify your bank: Contact your bank and inform them that you have voided a check. Provide them with the check number and the reason for voiding it. This step is crucial to ensure that your bank is aware of the situation and can take appropriate measures to prevent any unauthorized activity on your account.

- Destroy the voided check: Once you have completed the voiding process and notified your bank, securely destroy the voided check. This prevents anyone from attempting to use the check in the future.

Reasons to Void a Check

There are several reasons why you might need to void a check:

- Lost or stolen check: If a check is lost or stolen, voiding it is essential to prevent unauthorized use.

- Incorrect information: If a check contains incorrect information, such as the wrong amount or payee name, voiding it and issuing a new check with the correct details is necessary.

- Closed account: If you close a bank account, you should void any unused checks associated with that account to prevent any future issues.

- Voiding a postdated check: If you have issued a postdated check and want to cancel it before the specified date, voiding the check is the appropriate action.

FAQ Section

Q: Can I still use a voided check?

A: No, a voided check is invalid and cannot be used for any purpose, including making payments or depositing money into your account.

Q: What happens if I accidentally write “VOID” on a check?

A: If you accidentally write “VOID” on a check, you should contact your bank immediately and request a new check. The voided check should be securely destroyed to prevent any potential misuse.

Q: Do I need to notify the payee if I void a check?

A: It is generally not necessary to notify the payee if you void a check, as the check is now invalid and cannot be used. However, if you have already sent the check to the payee, it’s a good idea to inform them that the check is no longer valid and that you will be issuing a new one if necessary.

Q: Can I reuse a voided check?

A: No, a voided check should never be reused. Once a check has been voided, it should be securely destroyed to prevent any potential misuse.

Q: How long should I keep a voided check?

A: There is no specific time frame for keeping a voided check. However, it’s generally recommended to keep it for at least one year in case of any disputes or questions regarding the voiding process.

Summary Table

| Step | Description |

|---|---|

| Locate the check | Find the check you want to void. |

| Write “VOID” | Write “VOID” across the front of the check in large letters. |

| Destroy signature | Draw a line through the signature line. |

| Destroy MICR line | Draw a line through the MICR line at the bottom of the check. |

| Notify your bank | Contact your bank and inform them that you have voided a check. |

| Destroy the check | Securely destroy the voided check to prevent any potential misuse. |

For more information on check fraud and security measures, you can refer to the Federal Trade Commission’s guide on avoiding check fraud.

Conclusion

Voiding a check is a simple yet crucial step in maintaining the security of your financial information. By following the steps outlined in this guide and understanding the importance of voiding checks, you can protect yourself from potential fraud and unauthorized access to your bank account. Remember to always keep your checks in a secure location, and be vigilant when handling financial documents to prevent any issues.