How John D. Rockefeller Vertically Integrated His Monopoly in 1882

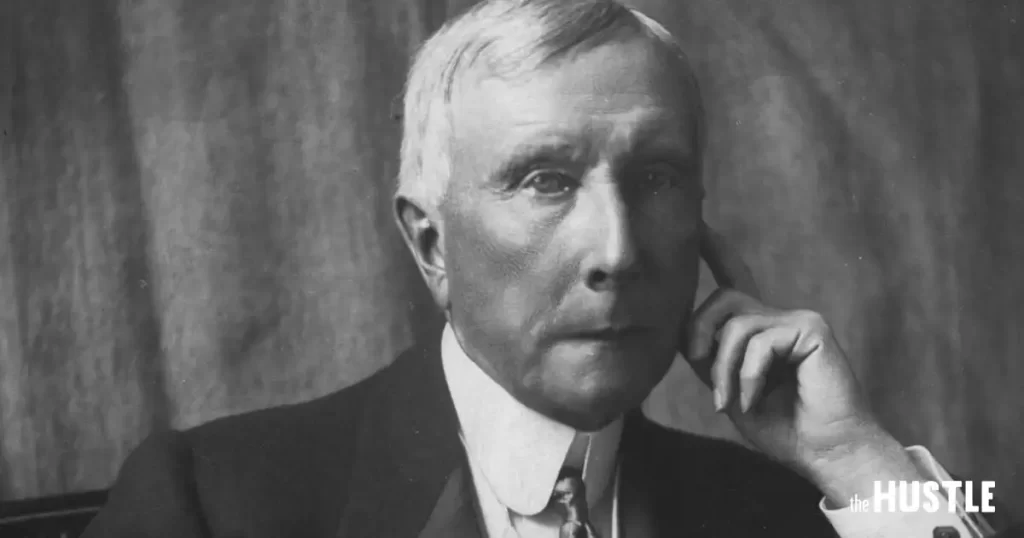

John D. Rockefeller, a name synonymous with wealth and industrial power, was pivotal in shaping the American oil industry during the late 19th century. His establishment of the Standard Oil Trust in 1882 marked a significant turning point in business practices, particularly in terms of vertical integration and monopoly formation. This article explores how Rockefeller achieved this, the tactics he employed, and the implications of his actions on American industry and society.

The Origins of Standard Oil

John D. Rockefeller was born on July 8, 1839, in Richford, New York. He began his business career at a young age and entered the oil industry in 1863 during a period of rapid growth following the discovery of oil in Pennsylvania. In 1870, he founded the Standard Oil Company with partners including his brother William Rockefeller, Samuel Andrews, Henry Flagler, and Stephen Harkness. The company initially focused on refining oil, which had lower variable costs compared to drilling.

Early Strategies for Market Control

From its inception, Rockefeller aimed to dominate the oil refining industry. By the early 1870s, he began employing aggressive tactics to eliminate competition:

- Cleveland Massacre (1872): Within a few months, Standard Oil acquired or forced the closure of 22 out of 26 rival refineries in Cleveland. This consolidation was achieved through offers that were often below market value or through intimidation tactics.

- Railroad Negotiations: Rockefeller negotiated favorable shipping rates with railroads by promising large volumes of oil shipments. This allowed Standard Oil to reduce transportation costs significantly compared to smaller competitors who could not guarantee such volumes.

- Secret Agreements: The infamous South Improvement Company deal aimed to secure rebates from railroads for shipping oil while charging competitors exorbitant rates. Although this deal was ultimately thwarted by public outcry and legislative action, it demonstrated Rockefeller’s willingness to engage in unethical practices to gain an advantage.

The Formation of the Standard Oil Trust

By 1882, Standard Oil had grown substantially and controlled approximately 90% of U.S. oil refining capacity. To manage this vast enterprise effectively and circumvent state laws that restricted corporate expansion, Rockefeller and his associates devised an innovative structure known as a “trust.”

What is a Trust?

A trust is a legal arrangement where multiple companies’ assets are pooled under a single management entity. In January 1882, Rockefeller established the Standard Oil Trust by consolidating the stock of several companies into a single holding company managed by a board of trustees. This structure allowed for centralized control over operations while maintaining the appearance of independent companies.

| Aspect | Details |

|---|---|

| Formation Date | January 2, 1882 |

| Initial Value | Approximately $70 million |

| Trustees | Nine trustees including John D. Rockefeller and key partners |

| Control | Managed various companies across multiple states |

| Market Share | Controlled about 90% of U.S. oil refining by the late 1880s |

Vertical Integration Tactics

Rockefeller’s approach to vertical integration involved controlling every aspect of production and distribution within the oil industry:

- Acquisition of Suppliers: Standard Oil acquired companies that supplied raw materials needed for refining operations, such as barrel manufacturers and pipeline companies.

- Pipeline Construction: By building extensive pipeline networks, Standard Oil reduced its reliance on railroads for transportation and further lowered costs.

- Retail Distribution: The company expanded into retail by establishing its own network of gas stations and selling kerosene directly to consumers at competitive prices.

- Product Diversification: Beyond kerosene, Standard Oil began producing various petroleum products including gasoline and lubricants, further solidifying its market dominance.

Impact on Competitors

Rockefeller’s monopolistic practices had profound effects on competitors and the broader market:

- Price Wars: When independent companies attempted to compete with Standard Oil, Rockefeller would often cut prices below cost temporarily to drive them out of business.

- Phantom Competitors: Standard Oil created fake companies that appeared to be independent competitors but were actually controlled by Rockefeller’s trust.

- Bribery and Intimidation: Reports emerged that Rockefeller used bribery to influence legislators and intimidate rivals into selling their businesses.

Legal Challenges and Public Backlash

As Standard Oil’s power grew, so did public concern over its monopolistic practices:

- Muckraking Journalism: Investigative journalists like Ida Tarbell exposed Rockefeller’s ruthless tactics in articles published in McClure’s Magazine. These revelations fueled public outrage against monopolies.

- Legislative Response: In response to growing concerns about monopolies like Standard Oil, Congress passed the Sherman Antitrust Act in 1890 aimed at curbing anti-competitive practices.

- State Lawsuits: By the late 1880s, several states filed lawsuits against Standard Oil for violating antitrust laws; however, Rockefeller’s company often evaded legal consequences through strategic maneuvering.

Conclusion

John D. Rockefeller’s establishment of the Standard Oil Trust in 1882 marked a watershed moment in American industrial history. Through aggressive tactics and innovative organizational structures, he created one of the largest monopolies in history while revolutionizing business practices through vertical integration.Despite his contributions to industrial efficiency and economic growth, his methods raised ethical questions about corporate power and competition that resonate today. The legacy of Rockefeller’s actions ultimately led to significant reforms in business regulation and antitrust laws aimed at protecting competition in American markets.

FAQ Section

Q1: What was vertical integration?

Vertical integration is a business strategy where a company controls multiple stages of production or distribution within an industry to increase efficiency and reduce costs.

Q2: How did John D. Rockefeller eliminate competition?

Rockefeller eliminated competition through aggressive tactics such as acquiring rival refineries at low prices during periods of financial distress (e.g., Cleveland Massacre) and engaging in price wars that drove competitors out of business.

Q3: What was the significance of the Standard Oil Trust?

The Standard Oil Trust allowed for centralized control over numerous companies while circumventing state laws limiting corporate expansion; it became a model for future conglomerates.

Q4: What led to legal challenges against Standard Oil?

Public concern over monopolistic practices led to investigations by muckraking journalists like Ida Tarbell and eventually prompted Congress to pass antitrust legislation such as the Sherman Antitrust Act in 1890.

Q5: What happened to Standard Oil after legal challenges?

In 1911, after years of legal battles over its monopolistic practices, the U.S. Supreme Court ruled that Standard Oil violated antitrust laws and ordered its dissolution into multiple independent companies.For additional information about John D. Rockefeller and his impact on the oil industry, you can visit Standard Oil – Wikipedia.