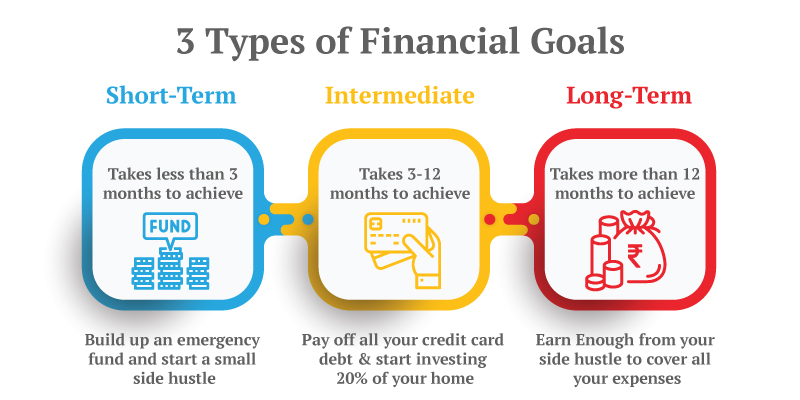

How Long-Term Financial Goals Differ from Short-Term Financial Goals

Understanding the distinction between long-term and short-term financial goals is crucial for effective financial planning. Each type of goal serves a different purpose and requires a distinct approach to achieve. Here, we will delve into the differences, examples, and strategies for setting and achieving both types of financial goals.

Definition and Timeframe

Short-Term Financial Goals:

- Definition: Short-term financial goals are targets that you aim to achieve within a relatively short period, typically ranging from a few months to five years.

- Examples: These goals include saving for a vacation, paying off credit card debt, building an emergency fund, minor home improvements, and personal goods purchases.

Long-Term Financial Goals:

- Definition: Long-term financial goals are more ambitious and take longer to achieve, often spanning five years or more.

- Examples: These goals include saving for retirement, paying off a mortgage, starting a business, and saving for a child’s education.

Differences in Planning and Execution

1. Timeframe and Flexibility:

- Short-Term Goals: These goals have more specific deadlines and are generally more flexible in terms of adjustments. For instance, if you are saving for a vacation, you might adjust your savings plan if your income changes.

- Long-Term Goals: Long-term goals often have less specific deadlines but require consistent effort over an extended period. For example, saving for retirement involves regular contributions to a retirement account over many years.

2. Priority and Urgency:

- Short-Term Goals: These goals are often more immediate and may require urgent attention. For example, paying off high-interest credit card debt is typically a high-priority short-term goal.

- Long-Term Goals: While important, long-term goals may not have the same level of urgency. However, they are critical for long-term financial stability and should not be neglected.

3. Financial Instruments:

- Short-Term Goals: For short-term goals, you typically use liquid savings accounts or easily accessible funds to ensure quick access to your money when needed.

- Long-Term Goals: Long-term goals often involve investments such as retirement accounts (e.g., 401(k), IRA), stocks, bonds, or other investment vehicles that can grow your wealth over time.

Strategies for Achieving Financial Goals

1. Setting SMART Goals:

- Both short-term and long-term goals should be Specific, Measurable, Achievable, Relevant, and Time-bound (SMART). This framework helps in creating clear objectives and tracking progress.

2. Budgeting and Allocation:

- Short-Term Goals: Allocate a portion of your monthly income towards short-term goals. Use the 50/30/20 budget rule as a guideline: 50% for necessities, 30% for discretionary spending, and 20% for saving and debt repayment.

- Long-Term Goals: Regularly contribute to long-term savings and investment accounts. For example, contribute 10% to 15% of your income towards retirement savings.

3. Emergency Fund:

- Having an emergency fund is crucial for both short-term and long-term financial stability. This fund helps in covering unexpected expenses without derailing your long-term plans.

4. Review and Adjust:

- Regularly review your financial goals and adjust them as necessary. Life changes, such as a new job or starting a family, may require modifications to your financial plans.

Balancing Short-Term and Long-Term Goals

Balancing short-term and long-term financial goals is essential for maintaining financial stability and achieving long-term success.

1. Prioritization:

- Prioritize your goals based on their urgency and importance. Ensure that you are not neglecting long-term goals while focusing on short-term ones.

2. Resource Allocation:

- Allocate your financial resources effectively between short-term and long-term goals. Use tools like budget calculators to help you manage your finances.

3. Passive Income:

- Consider generating passive income to support your long-term goals. This could include investments in dividend stocks, real estate, or other income-generating assets.

FAQ Section

Q: What is the primary difference between short-term and long-term financial goals?

- A: The primary difference lies in the timeframe. Short-term goals are typically achieved within a few months to five years, while long-term goals take five years or more to accomplish.

Q: How should I prioritize my financial goals?

- A: Prioritize your goals based on their urgency and importance. Ensure that you are addressing both short-term needs (e.g., emergency fund, debt repayment) and long-term aspirations (e.g., retirement savings, education fund).

Q: What financial instruments are best for short-term goals?

- A: For short-term goals, use liquid savings accounts or easily accessible funds to ensure quick access to your money when needed.

Q: How much should I save for long-term goals?

- A: For long-term goals like retirement, aim to save 10% to 15% of your income in tax-advantaged retirement accounts.

Q: Why is it important to review and adjust my financial goals?

- A: Regularly reviewing and adjusting your financial goals helps you adapt to changes in your life and ensures that you are on track to meet your objectives.

Q: How can I balance short-term and long-term financial goals?

- A: Balance your goals by prioritizing based on urgency and importance, allocating resources effectively, and using tools like budget calculators to manage your finances.

Table: Key Information

| Category | Description |

|---|---|

| Short-Term Goals | Achieved within a few months to five years; examples include emergency fund, credit card debt paydown, vacation |

| Long-Term Goals | Achieved in five years or more; examples include retirement savings, paying off a mortgage, saving for a child’s education |

| Timeframe | Short-term: flexible deadlines; Long-term: less specific deadlines but require consistent effort |

| Priority | Short-term: urgent attention; Long-term: critical for long-term stability but less urgent |

| Financial Instruments | Short-term: liquid savings accounts; Long-term: retirement accounts, investments |

| Budgeting | Allocate 20% of income towards saving and debt repayment for short-term goals; contribute 10% to 15% towards retirement for long-term goals |

| Review and Adjust | Regularly review and adjust goals to adapt to life changes |

| Balancing Goals | Prioritize based on urgency and importance; allocate resources effectively |

Additional Resources

For more detailed information on setting and achieving financial goals, you can refer to various financial planning resources.

Wikipedia or .gov Link

While there is no direct Wikipedia or .gov link specifically for the distinction between short-term and long-term financial goals, general information on financial planning can be found on reputable financial websites and government resources such as the U.S. Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA). This comprehensive guide should help you understand the differences between short-term and long-term financial goals, how to set and achieve them, and strategies for balancing both types of goals effectively. By prioritizing and managing your financial resources wisely, you can ensure a stable financial future.

Conclusion

Setting and achieving financial goals, whether short-term or long-term, is a critical aspect of financial planning. Understanding the differences between these goals and how to balance them is essential for maintaining financial stability and achieving long-term success. By following the strategies outlined here and regularly reviewing your goals, you can ensure that you are on the right path to realizing your financial aspirations.

Final Thoughts

Financial planning is an ongoing process that requires continuous effort and adjustments. By being proactive and informed, you can navigate the complexities of financial goal setting and achieve a secure financial future. Remember to prioritize your goals, allocate your resources effectively, and regularly review your progress to ensure you are on track to meet your financial objectives.